Otis Worldwide Corp (OTIS)

Sector: Industrials

Held since: 10 September 2020

Cost basis per share: $73.20

Portfolio allocation: 2.54% (#21 of 26 holdings)

Introduction

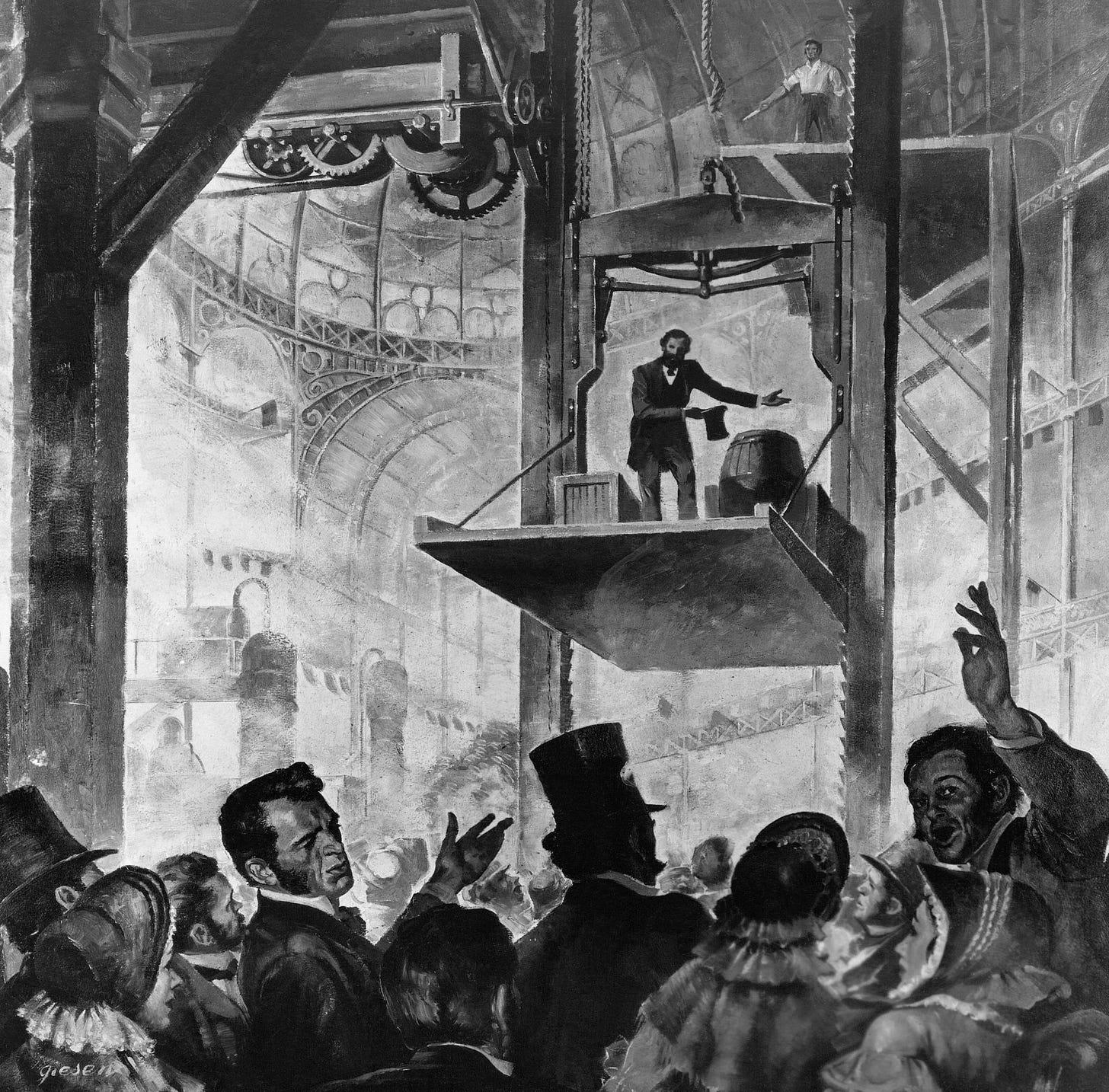

Otis Worldwide Corporation (NYSE: OTIS) stands as a testament to the power of innovation and longevity in the business world. Founded in 1853 by Elisha Otis, the inventor of the safety elevator, the company has grown to become the global leader in the manufacturing, installation, and servicing of elevators and escalators. With operations spanning over 200 countries and territories, Otis has built an unparalleled network that serves as both a competitive advantage and a barrier to entry for potential competitors.

The elevator and escalator industry, while often overlooked, plays a crucial role in urban development and the daily lives of billions. As cities grow taller and denser, the demand for efficient vertical transportation continues to rise. This secular trend, coupled with Otis' dominant market position, creates a compelling investment case for long-term, quality-focused investors.

Spun off from United Technologies in April 2020, Otis now operates as an independent, publicly-traded company. This separation has allowed management to focus exclusively on the elevator and escalator business, potentially unlocking value that was previously obscured within the larger conglomerate structure.

When analyzing Otis, it's crucial to look beyond traditional financial metrics and understand the underlying unit economics that drive the business. The company's operations can be broadly categorized into two segments: New Equipment and Service. While both contribute to the overall success of Otis, they have distinct characteristics that merit individual examination.

Business Model and Key Assets

New Equipment Segment (43% of sales, 22% of operating profit):

The New Equipment segment involves the design, manufacture, and installation of elevators and escalators. This segment is more cyclical in nature, tied closely to construction activity and economic conditions. However, it serves as the foundation for future service revenues.

Key considerations for the New Equipment segment:

Customer Acquisition Cost (CAC): In this context, the CAC can be thought of as the cost of winning a new equipment contract. This includes sales and marketing expenses, as well as any discounts or incentives offered to secure the deal.

Lifetime Value (LTV): The LTV of a new equipment sale extends far beyond the initial installation. It includes potential service contracts, modernization projects, and the likelihood of winning future new equipment contracts from the same customer.

Conversion Rate: This is the percentage of new equipment installations that convert into service contracts. Otis reports a global conversion rate of approximately 60%, with higher rates in developed markets (up to 90%) and lower rates in emerging markets like China (around 45%).

Service Segment (57% of sales, 78% of operating profit):

The Service segment, which includes maintenance, repair, and modernization of existing elevator and escalator systems, is the crown jewel of Otis' business model. This segment provides stable, recurring revenue with higher margins and is less sensitive to economic cycles.

Key considerations for the Service segment:

Customer Retention Rate: Otis boasts an impressive retention rate of over 94% globally. This high retention rate is a testament to the quality of Otis' service and the high switching costs for customers.

Average Contract Length: Service contracts typically span 4-5 years, providing visibility into future revenues.

Pricing Power: Otis has demonstrated the ability to increase prices annually, often tied to inflation indices, without significant pushback from customers.

Modernization Opportunities: As the installed base ages, modernization projects provide high-margin growth opportunities within the existing customer base.

Key Assets:

Installed Base: With over 2.2 million units under maintenance contracts, Otis' installed base is its most valuable asset. This portfolio provides a steady stream of high-margin service revenue and opportunities for modernization projects.

Global Scale and Density: Otis' extensive global presence allows for efficient service delivery and creates significant barriers to entry for potential competitors.

Brand Equity: The Otis name is synonymous with elevators, carrying with it associations of safety, reliability, and innovation.

Technological Capabilities: Otis' investments in IoT and predictive maintenance technologies, such as the Otis ONE™ platform, enhance its value proposition and create additional revenue opportunities.

Human Capital: With approximately 69,000 employees worldwide, including 40,000 field professionals, Otis' skilled workforce is crucial for maintaining customer relationships and delivering high-quality service.

Economic Moat and Competitive Advantages

Otis possesses a wide economic moat, stemming from several interconnected competitive advantages:

Scale and Network Effects: As the largest player in the industry, Otis benefits from significant economies of scale in manufacturing, R&D, and service delivery. The company's extensive service network creates a powerful flywheel effect – as the installed base grows, Otis can provide more efficient service, leading to higher customer satisfaction and retention, which in turn attracts more new equipment sales.

High Switching Costs: Once an Otis elevator is installed, building owners face significant costs and disruptions to switch to another service provider. These switching costs create strong customer loyalty and contribute to the high retention rates Otis enjoys.

Brand and Reputation: With over 170 years of history, the Otis brand is synonymous with safety and reliability. This brand equity is particularly valuable in an industry where safety is paramount, helping the company win contracts for both new equipment and service.

Regulatory Expertise: The elevator industry is highly regulated due to safety concerns. Otis' long-standing relationships with regulators and its track record of compliance create barriers for new entrants.

Technological Leadership: Otis' investments in IoT, predictive maintenance, and smart elevator technologies (e.g., Otis ONE™) enhance its value proposition and make it harder for smaller competitors to match its service quality.

Service Density: In many markets, Otis has achieved high service density, allowing for more efficient technician routing and faster response times. This operational efficiency is difficult for competitors to replicate without a similar scale of operations.

Data and Analytics Capabilities: With millions of connected elevators, Otis has accumulated vast amounts of operational data. This data allows for predictive maintenance, improved product design, and more efficient service delivery – advantages that are difficult for smaller competitors to match.

Financial Strength: Otis' strong balance sheet and cash flow generation allow it to invest in R&D, pursue strategic acquisitions, and weather economic downturns better than smaller competitors.

These competitive advantages have allowed Otis to maintain its market leadership position and generate returns on invested capital consistently above its cost of capital, a hallmark of a company with a strong economic moat.

Runway for Reinvestment and Growth

Otis has several avenues for reinvestment and growth, both organic and inorganic:

Urbanization and Infrastructure Development: The ongoing trend of urbanization, particularly in emerging markets, drives demand for new elevators and escalators. As cities grow vertically, the need for efficient vertical transportation increases. Otis is well-positioned to capitalize on this trend, especially in fast-growing markets like China and India.

Service Portfolio Expansion: Otis aims to grow its service portfolio from 2.2 million units to over 2.5 million by 2026. This growth will come from converting new equipment sales to service contracts, improving retention rates, and recapturing units currently serviced by competitors.

Modernization Opportunities: A significant portion of the global elevator installed base is over 20 years old and due for modernization. Otis expects the addressable modernization market to grow from about 500,000 units in 2023 to 900,000 units by 2028. This presents a substantial growth opportunity, as modernization projects typically have higher margins than new equipment sales.

China Market: Despite near-term challenges in the Chinese new equipment market, Otis sees significant long-term potential. The company's service portfolio in China has been growing at 20% annually, albeit from a low base. As the large installed base of elevators in China ages, it will drive demand for both service and modernization.

Digital and IoT Investments: Otis continues to invest in digital technologies like Otis ONE™, which enhances service efficiency and customer value. These investments not only improve margins but also increase customer retention and create opportunities for upselling additional services.

New Product Development: Ongoing R&D investments allow Otis to develop new, more efficient elevator systems. For example, the Gen360™ elevator, which uses drive-by-wire technology, offers improved performance and easier installation, potentially expanding Otis' addressable market.

Market Share Gains: In the fragmented service market, Otis has opportunities to gain share from smaller, independent service providers who may struggle to keep up with technological advancements and regulatory requirements.

Emerging Market Expansion: While Otis has a strong presence in developed markets, there's room for growth in emerging markets where elevator penetration is lower. The company can leverage its global scale and brand to expand in these high-growth regions.

Operational Efficiency: Otis' "Uplift" program aims to deliver $150 million in annual savings by 2025 through various efficiency initiatives. These savings can be reinvested in growth initiatives or flow through to improve margins.

Strategic M&A: While Otis focuses primarily on organic growth, it also pursues bolt-on acquisitions to expand its geographic reach or enhance its technological capabilities. The company typically allocates $50-100 million annually for such acquisitions.

Sustainable Building Trends: As the focus on energy efficiency and sustainable buildings grows, Otis can capitalize on the demand for more environmentally friendly elevator solutions, both in new installations and modernization projects.

The company's ability to execute on these growth opportunities while maintaining its competitive advantages will be crucial for long-term value creation.

Capital Allocation and Shareholder Returns

Otis has demonstrated a disciplined and shareholder-friendly approach to capital allocation since its spin-off in 2020. The company's capital allocation strategy balances reinvestment in the business, strategic M&A, debt reduction, and returns to shareholders through dividends and share repurchases.

Key aspects of Otis' capital allocation strategy include:

Reinvestment in the Business: Otis prioritizes organic investment to drive growth and maintain its competitive edge. This includes R&D spending (approximately 1.5-2% of sales), capital expenditures (about 1.5% of sales), and investments in digital initiatives and service capabilities.

Dividends: The company targets a dividend payout ratio of 35-40% of net income. Since the spin-off, Otis has consistently increased its dividend, demonstrating a commitment to returning cash to shareholders. The current dividend yield is approximately 1.4% (as of March 2024).

Share Buybacks: Otis has been aggressive in repurchasing shares since becoming an independent company. The company aims to return excess cash to shareholders through buybacks, with a target of reducing share count by 1.5-2% annually.

M&A: While focusing primarily on organic growth, Otis allocates $50-100 million annually for bolt-on acquisitions to enhance its geographic presence or technological capabilities. The company maintains a disciplined approach to M&A, ensuring acquisitions are accretive and strategically aligned.

Debt Management: Post spin-off, Otis has focused on deleveraging its balance sheet. The company targets a net debt to EBITDA ratio of approximately 2.0x, which provides financial flexibility while maintaining an investment-grade credit rating.

Financial highlights and capital allocation metrics:

Free Cash Flow Conversion: Otis has demonstrated strong free cash flow conversion, typically in the range of 100-120% of net income. This high conversion rate provides ample cash for reinvestment and shareholder returns.

Return on Invested Capital (ROIC): The company's ROIC has consistently exceeded its cost of capital, averaging around 30% in recent years. This high ROIC reflects the capital-light nature of the service business and Otis' competitive advantages.

Effective Tax Rate: Otis has made progress in optimizing its tax structure, with the effective tax rate declining from 31.0% in 2020 to 27.1% in 2023. Management targets a medium-term effective tax rate of 25-26%.

Capital Deployment: For the 2024-2028 period, Otis plans to deploy over $8 billion in capital, with more than $5 billion allocated to share repurchases.

The company's robust free cash flow generation and disciplined capital allocation approach provide flexibility to invest in growth initiatives while returning substantial capital to shareholders. This balanced strategy should support long-term value creation for Otis shareholders.

Management Quality and Incentives

A critical aspect of evaluating any investment is assessing the quality of management and their alignment with shareholders. In the case of Otis, the management team, led by CEO Judy Marks, has demonstrated a clear strategy for value creation and a commitment to balancing growth investments with shareholder returns.

Key considerations regarding Otis' management:

Experience and Expertise: CEO Judith Marks brings a wealth of experience from her previous roles at Siemens, Lockheed Martin, and IBM. Her background in technology and industrial companies aligns well with Otis' focus on digital transformation and operational excellence.

Clear Communication: Management has been transparent about their strategic priorities and capital allocation plans. They regularly provide detailed updates on key performance indicators and long-term targets.

Incentive Structure: Executive compensation is tied to key performance metrics such as organic sales growth, adjusted EBIT margin, and free cash flow conversion. This alignment helps ensure management's interests are in line with those of shareholders.

Track Record: Since the spin-off, management has delivered on their promises, consistently meeting or exceeding guidance and demonstrating progress on strategic initiatives.

Insider Ownership: While not at the levels of a founder-led company, Otis executives and directors do have meaningful ownership stakes, further aligning their interests with shareholders.

Culture of Innovation: Management has fostered a culture of innovation, evident in the company's continued investment in R&D and new product development.

Secular Theme: Urbanization and the Vertical Future

Otis Worldwide Corporation (OTIS) stands at the forefront of one of the most enduring and powerful secular trends of our time: global urbanization. This trend, characterized by the increasing concentration of populations in urban areas and the resulting vertical expansion of cities, provides a robust tailwind for Otis' long-term growth prospects.

Key aspects of this secular theme include:

Global Urbanization: According to the United Nations, 68% of the world's population is projected to live in urban areas by 2050, up from 55% in 2018. This shift represents an influx of billions of people into cities, driving demand for high-rise residential and commercial buildings.

Vertical Expansion: As cities grapple with limited land and growing populations, the trend towards taller, denser buildings continues to accelerate. This vertical growth directly translates to increased demand for Otis' elevator and escalator solutions.

Emerging Market Growth: Urbanization is particularly pronounced in emerging markets such as China and India, where rapid economic development is fueling massive urban migration. These markets represent significant growth opportunities for Otis, both in new equipment sales and long-term service contracts.

Aging Infrastructure: In developed markets, aging buildings and infrastructure create opportunities for modernization and upgrades. Otis is well-positioned to capitalize on this trend, with 21% of its elevator base older than 30 years.

Smart Cities and IoT Integration: As cities become "smarter," there's increasing demand for connected and intelligent building systems. Otis' investments in IoT and digital solutions align perfectly with this trend, allowing for predictive maintenance, improved energy efficiency, and enhanced user experiences.

Sustainability Focus: With growing emphasis on sustainable urban development, there's increasing demand for energy-efficient vertical transportation solutions. Otis' focus on developing eco-friendly products positions it well to meet this demand.

Infrastructure Spending: Global initiatives to upgrade infrastructure, including airports, metro systems, and public buildings, provide additional growth avenues for Otis.

The power of this secular theme is evident in Otis' resilience and growth potential:

Recurring Revenue Growth: As new equipment is installed, it feeds into Otis' service business, creating a growing base of recurring revenue. With a 90% conversion rate in Western markets (albeit lower in China), each new installation represents a long-term revenue stream.

Modernization Opportunities: The aging global elevator base presents significant modernization opportunities. Otis projects that its modernization business could potentially reach the scale of its current new equipment segment ($5-6 billion) over time.

Digitalization Driving Upgrades: The trend towards smart buildings is driving upgrades of existing elevators, further boosting Otis' service and modernization segments.

Resilience in Economic Cycles: While new equipment sales can be cyclical, Otis' large service base provides stability. In 2022, despite challenges in the construction market, Otis achieved 2.5% organic sales growth and 7.5% EPS growth, demonstrating the resilience of its business model.

China Diversification: While China remains a key market, Otis has been gradually reducing its reliance on the region. The percentage of revenue from China decreased from 19% to 17% from 2022 to 2023, having shrunk by 15% in dollar terms since 2021. This diversification helps mitigate risks associated with any single market.

Pricing Power: Otis' critical role in building infrastructure, combined with its brand reputation and the high switching costs for customers, provides significant pricing power. This is particularly evident in the service business, where customers have limited alternatives once an Otis system is installed.

In essence, Otis is not just riding the wave of urbanization; it's an integral part of enabling this global shift. As cities grow taller and denser, Otis' products and services become increasingly indispensable. This positioning at the heart of a long-term, global trend provides a solid foundation for sustained growth and reinforces Otis' potential as a "coffee can" stock - one that can reliably compound earnings power in the low teens over the next decade with minimal regulatory concerns or terminal value risks.

The secular theme of urbanization and vertical expansion creates a virtuous cycle for Otis: new construction drives equipment sales, which in turn expands the base for service contracts, leading to more recurring revenue and opportunities for modernization. This cycle, powered by global demographic shifts and urban development patterns, suggests that Otis is not just a participant in the urbanization trend, but a key enabler and beneficiary of the vertical future of our cities.

Valuation and Margin of Safety

When considering Otis as an investment, it's crucial to look beyond traditional valuation metrics and consider the company's long-term value creation potential. At its current valuation of approximately 26x free cash flow, Otis may not appear cheap by conventional standards. However, this valuation should be viewed in the context of the company's quality and growth prospects.

Key valuation considerations:

Durable Competitive Advantages: Otis' wide economic moat and market leadership position justify a premium valuation.

Recurring Revenue Model: The high-margin, recurring nature of the service business provides stability and predictability to cash flows.

Growth Potential: Multiple avenues for growth, including urbanization trends, modernization opportunities, and emerging market expansion, support a higher multiple.

Free Cash Flow Generation: Otis' strong free cash flow conversion (100-120% of net income) and capital-light business model allow for significant returns to shareholders.

Margin Expansion Opportunity: Ongoing efficiency initiatives and the shift towards a higher mix of service revenue provide potential for margin improvement.

While Otis may not offer a large margin of safety in terms of current valuation relative to near-term earnings, the company's quality and long-term growth potential provide a different kind of safety. The stability of the service business, combined with the company's competitive advantages, offers protection against significant downside risk.

Conclusion

Otis Worldwide Corporation represents a compelling investment opportunity for long-term, quality-focused investors. As the global leader in the elevator and escalator industry, Otis benefits from strong secular tailwinds, a wide economic moat, and a resilient business model that generates substantial free cash flow.

The company's service-driven approach, with its high-margin, recurring revenue streams, provides stability and predictability to earnings and cash flows. This stability, combined with multiple avenues for growth and operational improvement, positions Otis well for sustained value creation.

Key investment highlights include:

Market Leadership: Otis' position as the largest player in a consolidated industry provides significant competitive advantages in scale, brand recognition, and technological innovation.

Resilient Business Model: The company's service-driven approach provides stability and predictability to earnings and cash flows.

Growth Opportunities: Urbanization trends, modernization of aging elevator stock, and expansion in emerging markets offer multiple avenues for long-term growth.

Operational Improvements: Post spin-off, Otis has demonstrated a renewed focus on operational efficiency and margin expansion.

Strong Financial Profile: The company's high ROIC, strong free cash flow generation, and disciplined capital allocation strategy support ongoing reinvestment in the business and returns to shareholders.

Technology Leadership: Otis' investments in IoT and smart elevator technologies enhance its competitive position and create opportunities for value-added services.

While not without risks, including cyclicality in new equipment sales, competitive pressures, and macroeconomic uncertainties, Otis' strong competitive position and multiple growth drivers position the company well for long-term success.

For investors seeking exposure to global infrastructure trends and urbanization, with the stability of a service-driven business model, Otis Worldwide Corporation presents an attractive investment proposition. The company's ability to "go unnoticed" in its day-to-day operations while consistently delivering value to customers and shareholders alike makes it a potential core holding for long-term, quality-focused portfolios.

As with any investment, continual monitoring of the company's performance, industry trends, and potential disruptive forces will be crucial. However, Otis' strong foundation and management's clear strategy for value creation provide confidence in the company's ability to navigate challenges and capitalize on opportunities in the years to come.

Recommended Reading / Relevant Links

Junto Investments / Oliver Sung